"Hi, thanks for calling Stratton, Richard speaking."

"Hi Richard - I'm looking for a car loan. What's your best rate?"

If you're in the market for finance, chances are you've asked this question.

"Hi, thanks for calling Stratton, Richard speaking."

"Hi Richard - I'm looking for a car loan. What's your best rate?"

If you're in the market for finance, chances are you've asked this question.

It's an important question! But it's not the only question.

If you're serious about weighing up your options, there are a couple of questions you should be asking your consultant before you sign on the dotted line.

But firstly, why do we see rate everywhere?

When it comes to loans and finance, we've been conditioned to associate low rates with good value.

In finance advertising, rates are everywhere. TV, billboards, brochures, radio - especially at peak sales periods such as the end of financial year, advertisers put their rates up in lights.

A low interest rate may be bundled with other loan conditions that outweigh the savings offered by the rate.

Interest Rates: The Tip of The Iceberg

Interest Rates: The Tip of The Iceberg

You want to borrow $15,000 over three years. You've found yourself a competitive interest rate - great start!

You think you've hit a home run, but you're probably only at first base. There are more questions you should be asking.

It's no secret that fees and charges can stack up.

But what if they outweigh the savings offered by a great rate?

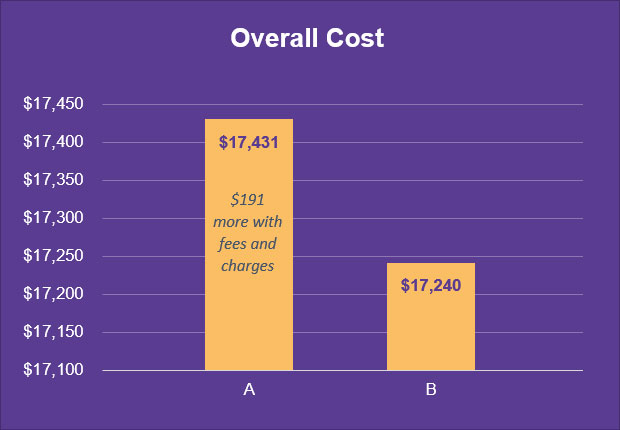

Take the example of these two loans. Both car loans for $15,000 over 3 years.

Looks like Loan A is a better deal, right?

Not necessarily.

Let's look at the potential total cost of those same two loans, over the full life of the loan.

Rates used above are examples only. Please speak with a stratton finance consultant for more information on the interest rates available to you.

Loan A suddenly isn't looking so hot.

With a $395 establishment fee, and $10 monthly account keeping fee, the savings offered by that low rate are eaten up pretty quickly. In the end, if you took Loan A, you would pay $191 more overall.

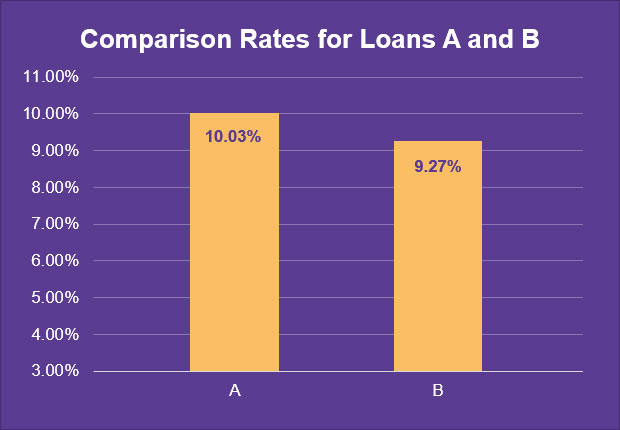

The simplest way to compare loans, including fees and charges, is to look past the advertised headline rate to the comparison rate, or true interest rate, which will better indicate the true cost of the loan.

The comparison rate includes the interest rate plus most fees and charges.

However even the comparison rate does not include government charges (such as stamp duty), or fees which may or may not be charged (such as early payout fees).

Which is why it's important you also ask Question 2.

It does pay to think ahead. We know many people decide to pay out their loans early.

If you plan to pay out your loan ahead of time, or there's a chance you'll want to upgrade your car before you've made all the payments on your loan, you need to be thinking about early exit fees.

As with upfront fees, while some lenders offer really exciting rates, those savings can quickly disappear if you want to get out early.

Another example.

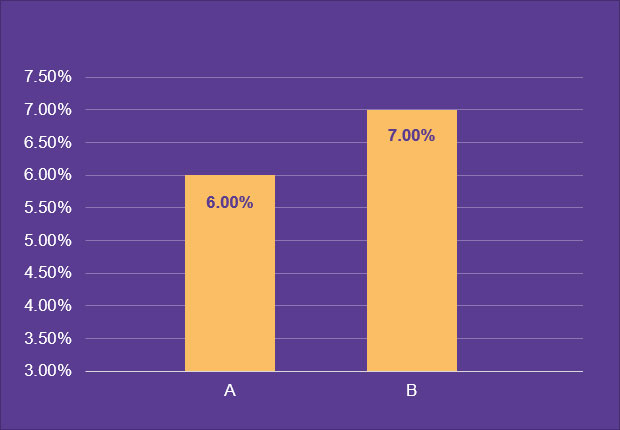

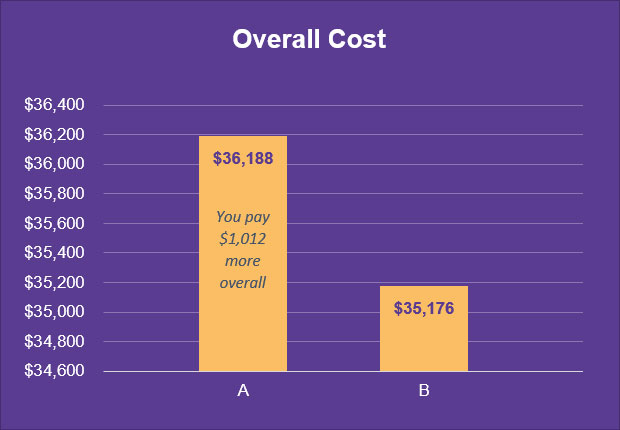

Two loans (both $30,000 chattel mortgages, with five year terms, with no residual).

A 6.00% interest rate sounds good, the upfront fees are reasonable and there is no monthly account keeping fee.

Then, three years into your five-year loan, you get a great tax return! You decide to combine that with some savings to payout your loan early.

Unfortunately, your low rate loan has an early exit fee.

For the second time in one short article, that amazing interest rate on Loan A isn't looking like such a great deal. When you take into account the early exit fee, that tantalising low interest rate has cost you $1,012.

If you're sure that's the case, great! Option A will probably be the better deal after all.

The bottom line is it's worth checking.

This is why discussing your plans for your next car with your consultant is so important. If you want to pay out your loan early, that could be the difference between Loan A and Loan B representing the best value for you.

One more question before you sign.

Let's look at this another way.

You've found a loan with a great rate. And reasonable fees. Reasonable establishment fees, no monthly account keeping fees, and no early payout. You're happy with the total cost of the loan.

While this may be a great deal for some people, you need to be sure it's right for you.

While this might sound strange, we speak with people daily who would be happy to pay more for their loan in total.

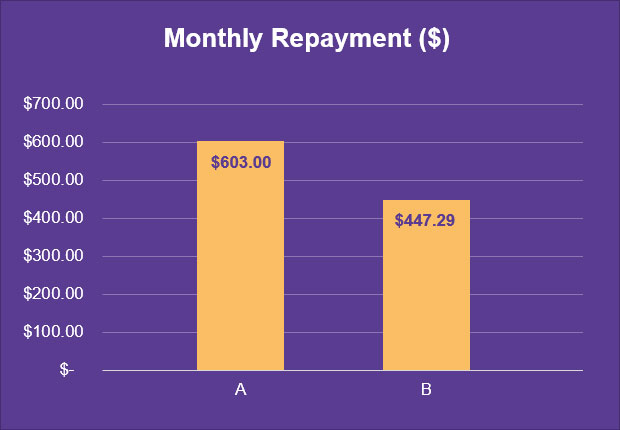

Let's look at two loan options one more time.

Loan A is the loan for you, right?

Maybe for you, but not necessarily for everyone.

While Loan B has a higher overall cost, the monthly repayments are much lower.

Loan B has a 30% residual (a lump-sum or balloon payment at the end of the loan term), while Loan A has no residual or balloon payment.

This means that while you'd pay more overall for Loan B, you would enjoy lower monthly repayments.

While we wouldn't suggest everyone pay more overall to get a low monthly repayment, for some of our customers, that's what makes the loan right for them.

If you know you're going to upgrade your car at the end of the loan, choosing a residual payment allows you to use the money from the sale of your car to make that final lump sum payment.

An experienced broker will help you choose a sensible balloon payment. This may make your loan more affordable, allow you to borrow more and give your application the best chance of being approved.

Great - let's chat.

We've got some of the best rates in the market, and we'll show them to you, complete with all the fees and charges.

Beyond rates, though, we know we offer the best service in the industry.

Good service is hard to define, but with our combination of experience and our wide panel of lenders, we go beyond a great rate to help you find a loan that fits you perfectly, and we work to give it the best chance of first-time approval.

A low rate doesn't always mean a great deal. The loan structure that's right for you won't be right for everyone.

While you may want the lowest total loan cost, your neighbour may want low monthly repayments, while your work colleague may like to upgrade their car every year or two, so a loan with no early exit fees might save them a lot of money.

If you're judging a loan on the interest rate alone, you don't know if it's good value or not.

If you’ve found a good rate, we’ll help you check it over. If it's as good as it sounds, and we can't do better, we'll tell you!

Whether it's a low rate, early exit option or low repayment loan you're after, we'll compare options a range of lenders to check you've found the best deal for you.

To put your loan to the Stratton test, get in touch with your dedicated consultant by calling 1300 STRATTON (787 288) or submit a 60-second online quote.

info@stratton.com.au

1300 787 288

1/435 Williamstown Road Port Melbourne, VIC, 3207

Loading

No matching articles found.

It looks like there are no posts available for the selected topic. Try exploring a different topic or resetting your filters.