About novated leasing with us

Effective 1st July 2021, Stratton Finance's novated leasing management division has become Clear Lease.

Already a customer?

Whilst the name, ownership and management are changing, our existing team are here to support you through the transition in a seamless manner.

All existing novated leases will operate as normal, and if you're an existing customer, you'll be contacted directly by Clear Lease about the transition, or can contact them on 1300 728 702. In the meantime, you can still access your account below.

Why a novated lease?

No GST

Pay no GST on the purchase price of your vehicle - saving you 10% on the price of your car.

Save on tax

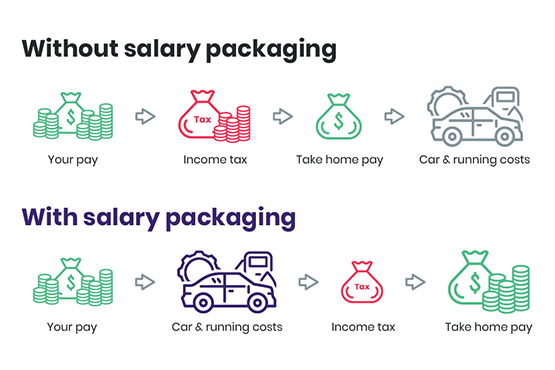

Your car repayments and running costs are paid mostly with pre-tax dollars so you enjoy a lower tax rate.

Fuel savings

Enjoy $0.04 off per litre with your own fuel card.

Common questions about novated leasing

Under a novated lease, you purchase the vehicle and then “novate” the finance agreement to your employer. As a result, your employer agrees to take on your obligations (repayments) to the finance company, and is responsible for all of the agreed vehicle expenses which are deducted from your remuneration as part of your salary packaging arrangement. You agree to "salary sacrifice" a portion of your earnings in return for the benefit of a car equal to that amount. With a Novated Lease, the lease, running costs of the vehicle and Fringe Benefits Tax (FBT) are deducted from your pre-tax earnings, and PAYG income tax is calculated on your reduced salary. This can effectively increase your net disposable income as you pay less tax.

Novated leasing offers many benefits for employees including tax efficient structuring of your car expenses (by paying them from your pre-tax income, giving you the ability to choose your own vehicle (as opposed to being given a fleet car), providing you the ability to use 100% of the time, allowing you to move the lease around between employers and giving you the ability to potentially benefit from any profit realised on sale (over and above your payout figure).

Like a car loan, your repayments are fixed and you can select an appropriate term as well as a residual (or balloon) in many cases.

Importantly, under a novated lease, the financier applies an Input Tax Credit (ITC) to remove the GST from the amount financed. This means that your repayments will be lower as you finance a reduced, GST-exclusive amount. Under a salary packaging arrangement all finance and operating costs for the vehicle are known as a "related benefit" and are GST and income tax-exempt.

If you are working full time or permanent part time and your employer supports salary packaging - you're eligible.

Novated Leasing also offers a number of benefits for employers including the ability to provide more flexible remuneration to employees at little-or-no cost to your business, significant savings of time and money compared to the administration of a company fleet and the elimination of the residual-value risk of a company fleet.

As the employer, you are not responsible for the vehicle if an employee leaves, and is not left with vehicles surplus to requirements and vehicles provided under a Novated Lease are "off balance sheet" - neither an asset nor a liability.

There are a number of potential vehicle expenses that can be included in your novated lease including comprehensive insurance, registration, fuel costs, maintenance such as servicing and tyres as well as roadside assistance.

Looking for more information?

We've made it easy for you to find everything you need here.

EXCEPTIONAL, as good as Customer Service gets

I’ll keep this simple, if you want the BEST advice, the BEST service and the BEST product for your c...

Can't Recommend Highly Enough!!

Have purchased two vehicles through Stratton Finance and each time the service has been fantastic. S...

Stratton Finance A++

I've purchased 3 vehicles using Stratton and every time it has been hassle free. Not hidden nasties ...

Meet our partners

We partner with industry leaders to streamline the process, ensuring we get the keys in your hands more swiftly and efficiently.

Let's get started

Obligation free and no impact to credit score